- Despite Working Your Hides Off, Are You Worried About Your Small Construction Business Working Capital?

- Moreover, Are You Having A Tough Time Trying To Keep Track Payments Of Those Clients Who Haven’t Yet Cleared Off Their Unsettled Invoices?

If so then; you are not alone!

Ask anyone who is in charge of a small-scale business. They will tell you how important maintaining a recurring cash flow is for smooth business operations. Cash flow is irrefutably the life force for all sized business.

And perhaps the biggest lesson on managing cash flow is –

The quicker you the unpaid cash from your consumers, the easily will it get to proper manage your business cash flow.

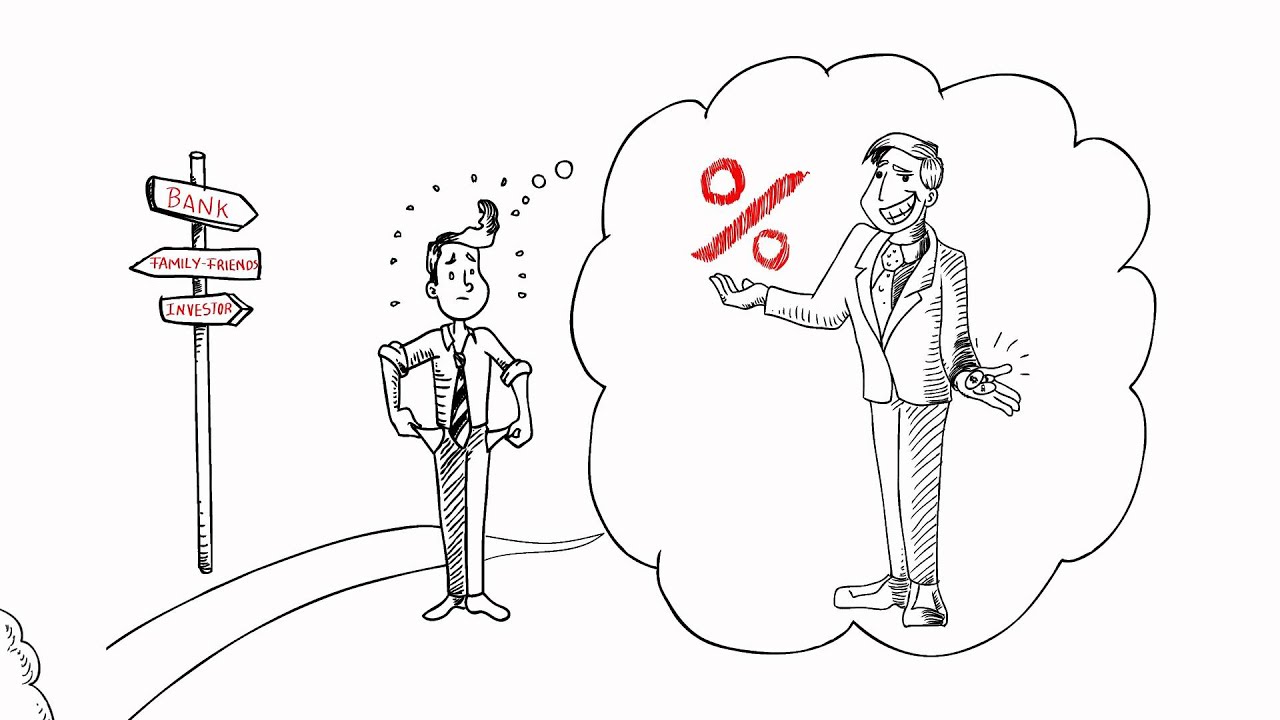

Statistics Point Out- With The Total Number Of Banks Declining By 3.5% From 2010 Onwards, A Lot Of Small Scale Business Runners Are Left With Very Little Options To Go With.

To make matters worse, even the leftover banks refrain from working with small-sized construction businesses. This is because their requested loans take a lot of time to process and potentially come with minimal or no return at all. So these banks consider it as not profitable for them.

But; you being the construction business owner need the money to meet the monthly bills and clear out your employee’s salaries.

SO…, WHAT’S THE ALTERNATIVE SOLUTION?

In sharp contrast to the traditional methods of procuring finances (which in your case proved utterly unhelpful), you can alternatively opt for invoice financing from a quality factoring company.

That’s right! These construction factoring companies prove to be your much appreciative lifeline as they provide you with the working capital by paying for your amounts receivable.

Explaining Further the True Importance of Invoice Factoring Companies

- You Get Instant Money with Minimal Paperwork

Due to the minimal paperwork involved; you get set within 3 business days. After you form a relationship with your chosen factoring company; you receive quick access to the much–needed cash from your existing unpaid receivables.

In fact, the day you submit your invoice is invariably the day you get the money.

- There Are No Such Extra Debts Added To Your Company’s Balance Sheet

This is another reason why so many small construction business owners opt for invoice financing from quality construction factoring companies. They aren’t loans. Nor are they any debts. They are your money which you receive a tad earlier than usual to fill in the gaps.

Furthermore, you will even find no extra debts added in the balance sheet of your company.

- In Comparison To Other Traditional Options, the Invoice Financing Rates Are Lower

Invoice financing is a far better alternative in comparison to the other traditional 60-90 day credit extension options such as –

- Bank Loans

- Credit Lines

- Merchant cash advances

- Liquidating company assets to clear off payments

And its invoice financing rates are low and prove way easier for you to manage.

- Invoice Financing Ensures Your Peace of Mind

It’s true. Opting for invoice financing ensures you will always have the funds needed to clear off your obligations and debts. Rather than letting you waste any more time worrying over cash flow, it provides you with the necessary cash and lets you focus on growing sales, customer satisfaction and other key business aspects.

Now Let’s Move Over To Understanding the True Cost of Invoice Factoring

Most invoice factoring companies deliver you 24–hour early invoice payment on a discounted rate. When using a factoring company, you are selling your invoice in less than its face value for cash advances ranging between 60-80% of the total invoice sum.

Your chosen factoring company holds this amount till the full balance is cleared off. And once that is done, your factoring firm will also pay you the disputed amounts and returns along with the balance less factoring fee.

This factoring fee can be 5%, or above the invoice face value for the initial 30–day span, the invoice stays unpaid. Moreover, the extra fee will also be collected if the invoice takes more time to be paid off.

Moreover, most top factoring companies will orient their fee depending on these crucial factors. Follow closely!

- The volume of factor fee – high volume means the low fee (& vice-versa)

- The Invoice sum – high invoice amount means the low fee (& vice-versa)

- The customer’s credit quality – good credit quality means the low fee (& vice-versa)

- The recourse and non-recourse – the cost to factor for recourse is lower in comparison to non-recourse simply because in recourse you are entitled to clear off the unpaid amount

- Your business’ credit quality – high credit quality means the low fee (& vice-versa)

If you wish to know more about the costs of invoice factoring for your construction company, get in touch with a top service provider today. Their experts will; be happy to answer your questions and clear out your doubts.