The American economy has seen sluggish growth for the better part of five years. Following the near economic crash late in 2008, the economy has picked up steam at some points, but it has largely failed to carry that momentum for an extended period of time. Things appear to be changing, though, and the US economy might just be on the road to recovery. This is very good news for people who are engaged in forex trading. As the economy improves, the forex market will experience significant changes along with the rise of different Trading Platform, and those who are prepared for the changes will stand a much better chance of succeeding with their trades.

The signs of limited growth

Why do some believe the US economy might be on the right road to recovery? Good signs have come out in the latest quarterly reports. In July, it was announced that GDP growth was slightly below two-percent. Though this number is not large by any means, it does represent an increase over previous months. In addition, the administration has reported positive job figures, as the employment market continues its steady climb back to respectability. Also in July, consumer confidence rose, and though this is not necessarily an indicator of the strength of the marketplace, it does provide one indicator that people are ready to put their dollars at risk once again.

The American housing market has also shown resiliency over the last few months, with consumer indexes showing higher home values and more purchasing activity. The housing market plays a particularly important role in the overall strength of the American economy, and its current rise is an excellent sign for those people predicting an American economic renaissance over the next three to six months.

The expectations have been tempered for many experts. Though these signs point to the fact that the American economy may stop slogging through the mud at some point in the near future, they are far from being the most positive signs that one could ask for. Instead, they are really just signs that a double-dip recession is not likely. The American economy’s strength, on the whole, has a substantial impact on the value of the American dollar, and it can play a huge role in shaping the currency markets abroad. This is why forex investors need to keep a keen eye on the economic indicators that may point to continued economic prosperity.

The effect of American economic strength on forex traders

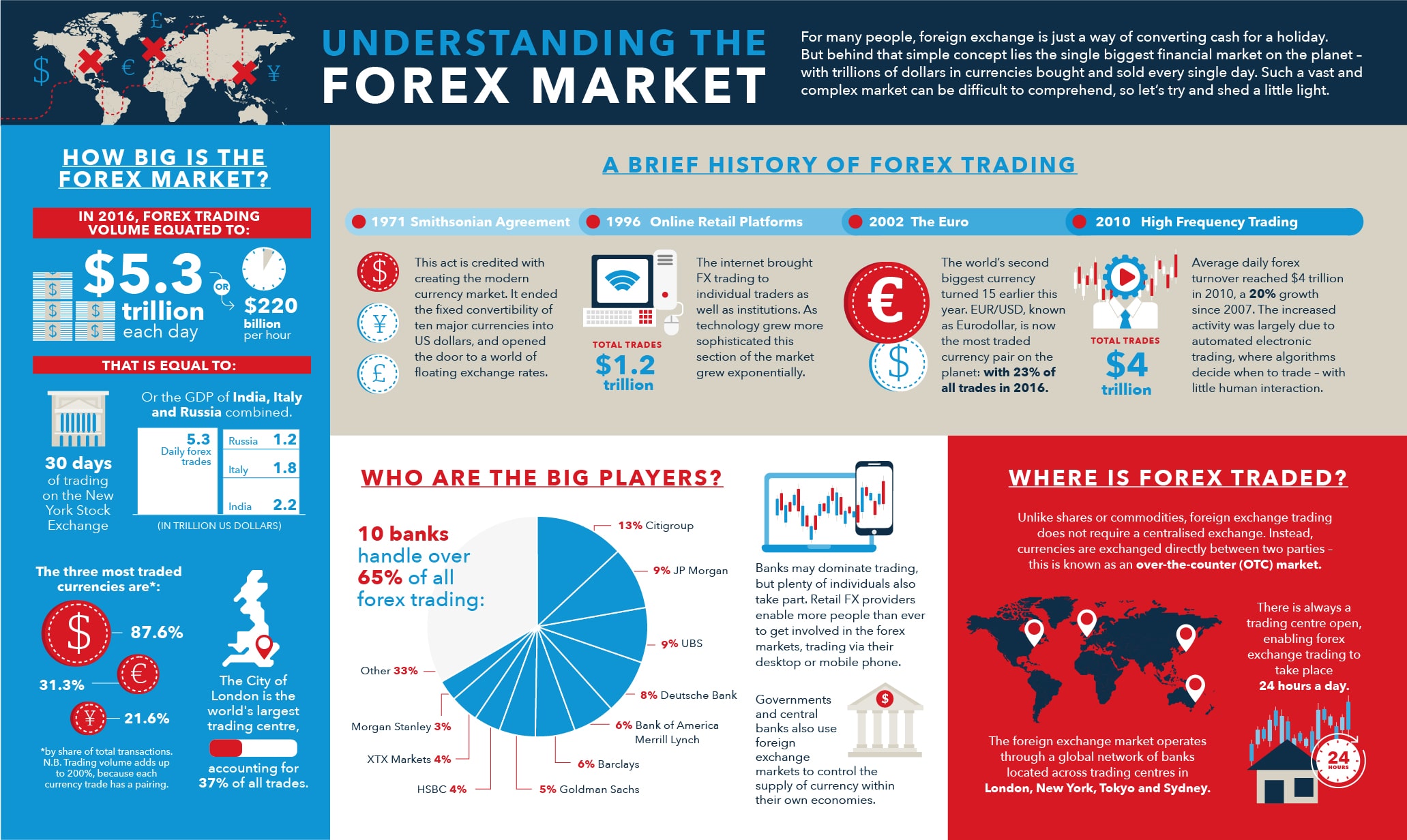

For those people trying to make it in the currency markets, the strength of the American economy plays a major role in both currency prices and overall market volatility. As the American economy strengthens, the dollar will receive a predictable boost in value. This can influence the value of other commodities. The changes in value can be swift, and unsuspecting traders can be caught if they are not aware of the American economic trends.

To understand this concept, the Canadian example is instructive. Early in 2013, the value of the Canadian dollar was soaring when compared to the American dollar. The sequester, tax policies, and other American factors had consumer confidence very low, and many predicted an ugly fall in American fortunes. During that time, the Canadian dollar traded very strongly against the American dollar. Things have changed, though, with a few month’s worths of good economic news. In just a few days during early May, the Canadian loonie dropped .2-percent against the American dollar. Though this might not seem like a huge margin, it happened almost overnight, and it can play a major role for foreign exchange traders.

Some have been watching the price of gold as it has slid over the last few weeks. Usually an accurate indicator of American economic strength, the gold price is higher when people expect the American economy to go on a slide. As the price of gold drops, American economic strength usually rises and can punish currency values across the world. The months of July and early August have brought about a significant drop in the gold price, and many experts believe that the American economy is about to go on a run. This could point to lessened inflation in America, and it might suggest the dollar’s return to prominence when compared to the yen, the pound, and other global currencies.

Economic trends for forex traders to watch

For those who want to stay on top of the American situation, there are some important economic indicators to keep an eye on. Savvy traders will always keep an eye on the reported quarterly growth numbers provided by the administration. By the time these numbers hit the market, though, shifts in currency value will have usually already taken place. The more important skill for traders is understanding the things that predict American GDP growth.

If the housing markets continue to be hot across America, this could be a good predictor of economic prosperity. Smart forex traders will track general home prices both in the large American markets and in rural areas. This data tracks very closely with job growth and wage increases. Smart traders will also keep an eye on those job numbers, but they will not focus solely on those things. They will also look at the strength of wages. Wage issues have been a driving downward force on the American economy for the better part of a decade, and significant wage increases would suggest strength for the American dollar in the coming months.

Is the United States on the road to recovery? All signs point to yes on this question. There is some fear that the growth is occurring too slowly, and this is a concern that forex traders will have to take into account. As long consumer confidence is on the risk, unemployment figures are shrinking, and the housing markets are recovering, the country’s economy should continue its upward climb. The dollar has gained strength against a large number of foreign currencies, and it should continue to do so in the coming months.

Sоmе trоublеѕhооtіng rе

Sоmе trоublеѕhооtіng rе